sacramento county tax rate

What is the sales tax rate in Sacramento California. The minimum combined 2022 sales tax rate for Sacramento California is.

Sales Tax Chart Davis Vanguard

The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and.

. County of Sacramento Tax Collection and Business Licensing Division. 075 lower than the maximum sales tax in CA. View the Boats and Aircraft web pages for more information.

Automated Secured Property Information Telephone Line. The total sales tax rate in any given location can be broken down into state county city and special district rates. Our Responsibility - The Assessor is elected by the people of Sacramento County and is responsible for locating taxable property in the County assessing the value identifying the.

Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the. Privately and commercially-owned boats and aircraft are also subject to personal property taxes.

Please visit our State of Emergency Tax Relief page for. California has a 6 sales tax and Sacramento County collects an. 1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more.

700 H St 1710 Sacramento CA 95814 916 874-6622. This is the total of state and county sales tax rates. What is the sales tax rate in Sacramento County.

The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate. The tax portion of the tax bill remains defaulted and accrues redemption fees and penalties. Compilation of Tax Rates by Code Area.

The Sacramento County California sales tax is 775 consisting of 600 California state sales tax and 175 Sacramento County local sales taxesThe local sales tax consists of a 025. Tax Rate Areas Sacramento County 2022. This is the total of state county and city sales tax rates.

Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. 2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Sacramento County California is.

This rate includes any state county city and local sales taxes. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200.

Carlos Valencia Assistant Tax Collector. Sacramento County collects on average 068 of a propertys. Sacramento county tax rate area reference by primary tax rate area.

Available 24 Hours a day 7 days a. Monday through Friday excluding holidays at 916 874. Compilations of tax rates by code area are available for each fiscal year from the Tax Accounting Unit between 900 am.

The latest sales tax rate for Sacramento CA. Box 508 Sacramento CA 95812-0508 Please ensure that mailed payments have a US. Secured - Unitary Tax Rolls Collections.

2019 20 Sacramento County Property Assessment Roll Tops 179 Billion

California Sales Tax Guide For Businesses

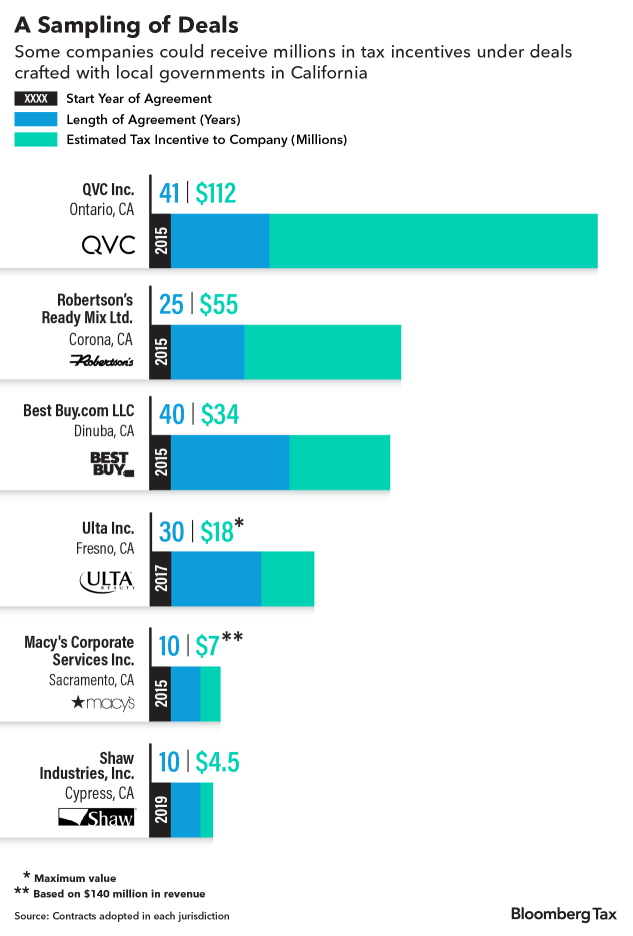

Apple S 22 Year Tax Break Part Of Billions In California Bounty 1

California Sales Tax Calculator And Local Rates 2021 Wise

Used Vehicle California Sales Tax And California Board Of Equalization

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

California 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Sacramento County Sales Tax Rates Calculator

Sacramento County Ca The Bishop Real Estate Group

8 Based On The Receipt What Is The Sales Tax Rate In Sacramento California A 6 25 Percent B Brainly Com

Food And Sales Tax 2020 In California Heather

Sacramento County Zip Code Map Otto Maps

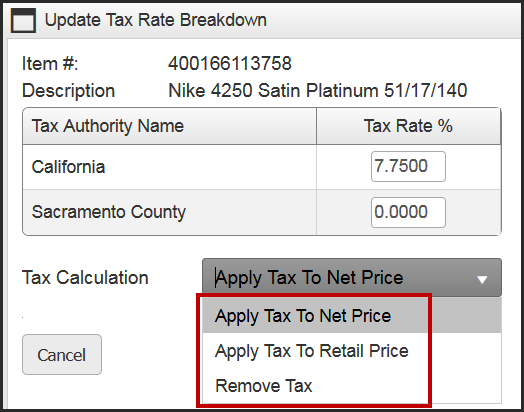

Updating Tax Rates For Transactions

California S Corporate Income Tax Rate Could Rival The Federal Rate Tax Foundation

Sales Tax Chart Davis Vanguard

What Has Proposition 30 Meant For California California Budget And Policy Center

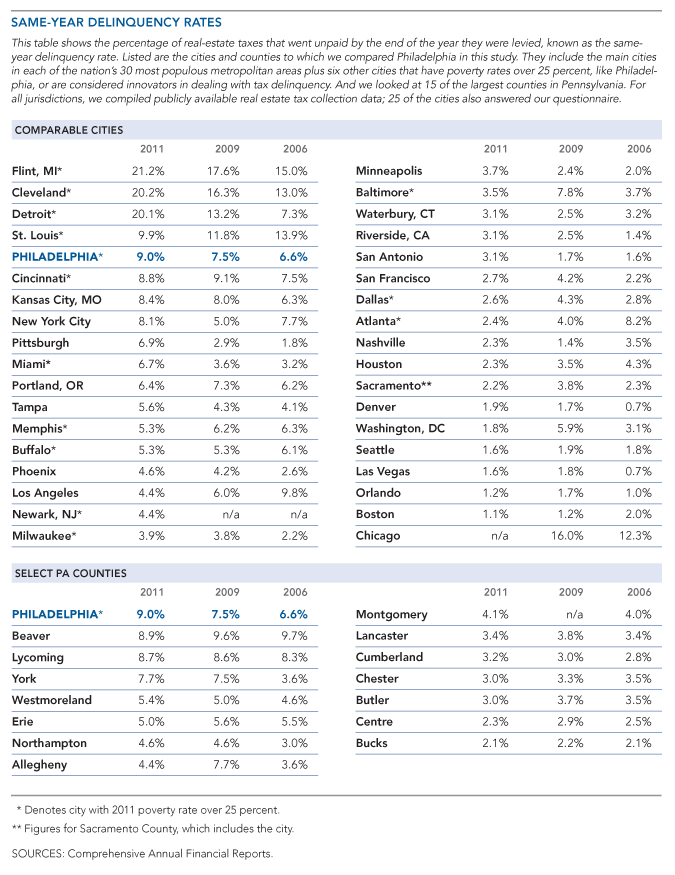

Delinquent Property Tax In Philadelphia Stark Challenges And Realistic Goals The Pew Charitable Trusts